The automotive and insurance industries are undergoing a remarkable transformation driven by technological innovation and data analytics. Traditional car insurance and maintenance models are evolving to be more dynamic, personalised, and cost-effective. Two prominent developments shaping the future in 2025 are Pay-As-You-Drive (PAYD) insurance and predictive maintenance powered by connected vehicle technology.

This article explores these groundbreaking trends, explaining how PAYD insurance aligns premiums with actual usage to reward safer, lower-mileage drivers, and how predictive repair technologies optimise vehicle upkeep—offering benefits to owners, insurers, and service providers alike.

Understanding Pay-As-You-Drive (PAYD) Insurance

Pay-As-You-Drive insurance is a usage-based insurance model that calculates premiums according to the number of kilometers or miles a vehicle travels, unlike traditional fixed-rate auto insurance. This means drivers who use their cars less frequently or drive more cautiously can save money by paying only for what they consume.

How PAYD Works in 2025

- Mileage Tracking: Using odometer readings, GPS devices, or telematics systems embedded in the vehicle or via mobile apps, insurers track the actual distance driven.

- Customized Premiums: Insurance companies adjust premiums dynamically based on recorded mileage during the policy period, often with tiered or granular pricing slabs rewarding low usage.

- Driving Behavior Analysis: Some PAYD plans leverage telematics to assess driving habits such as speed, acceleration, braking, and cornering to factor risk-adjusted pricing.

- Flexible Plans: Drivers can choose coverage that fits their lifestyle, adjusting declared mileage during renewal or opting for add-on policies.

Benefits of PAYD Insurance

- Cost Savings for Low-Mileage Drivers: Commuters who drive infrequently, urban residents relying on public transport, or owners of secondary vehicles enjoy significant premium reductions.

- Encouraging Eco-Friendly Transportation: PAYD incentivizes reduced driving, indirectly lowering carbon emissions and traffic congestion.

- Increased Transparency: Usage-based pricing makes insurance costs more understandable and fair, avoiding subsidies from low-risk drivers to high-risk heavy users.

- Behavioral Improvements: Real-time feedback and rewards encourage safer driving practices.

The Rise of Predictive Maintenance in Vehicle Care

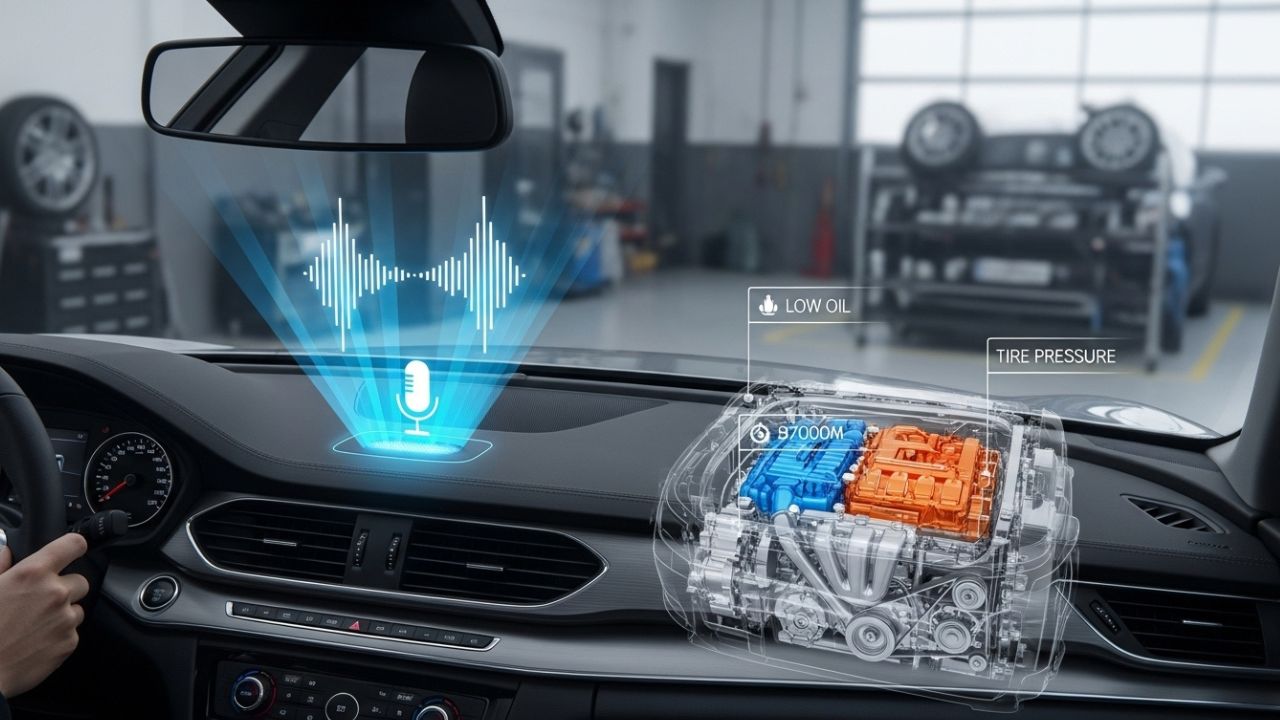

Predictive maintenance refers to techniques that use data analysis, machine learning, and connected vehicle diagnostics to predict when vehicle components will need servicing or replacement before failure occurs. This represents a proactive shift from traditional preventive or reactive maintenance.

How Predictive Repairs Work

- Continuous Monitoring: Sensors collect data on engine temperature, vibration, oil quality, tire pressure, and other key parameters.

- Data Analytics & AI: Advanced algorithms analyze trends and anomalies to forecast component wear or potential breakdowns.

- Maintenance Alerts: Drivers and fleet managers receive timely notifications suggesting specific repairs or part replacements.

- Optimized Service Scheduling: Instead of fixed intervals, maintenance occurs precisely when needed, reducing unnecessary work and downtime.

Benefits of Predictive Vehicle Maintenance

- Cost Efficiency: Early fault detection prevents catastrophic failures that lead to expensive repairs.

- Improved Vehicle Uptime: Accurate scheduling reduces downtime, enhancing fleet productivity and convenience for personal owners.

- Extended Vehicle Longevity: Timely interventions preserve parts and systems longer.

- Enhanced Safety: Prevents accidents caused by mechanical failures through early intervention.

- Comprehensive Data Records: Maintenance history and diagnostics create a transparent vehicle health profile, bolstering resale value.

PAYD and Predictive Repairs: Complementary Innovation

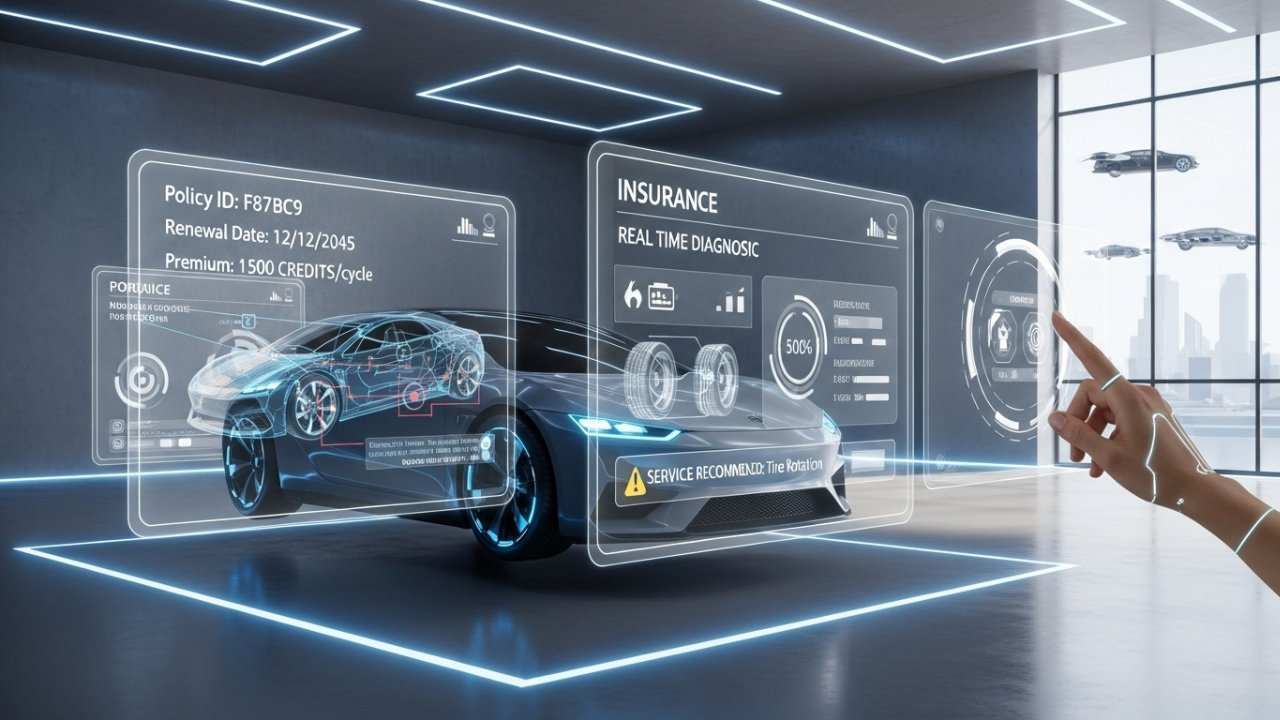

In 2025, the convergence of PAYD insurance and predictive maintenance is creating integrated ecosystems.

- Data Sharing: Insurers and service providers collaborate using telematics and diagnostic data to offer tailored insurance and maintenance plans.

- Personalized Policies: Insurance policy premiums and deductibles adapt based on maintenance compliance and driving profiles.

- Smart Alerts: Vehicle health alerts in real-time can trigger insurance adjustments or service offers, enhancing customer engagement.

- Sustainability Goals: Reduced unnecessary driving and maintenance align with corporate and governmental environmental policies.

Challenges and Considerations

- Privacy and Data Security: Collecting and sharing telematics data raises concerns regarding user privacy and data protection that insurers and service providers must address.

- Accessibility and Equity: PAYD and predictive maintenance technologies require smartphone access and connected vehicles, potentially excluding lower-income or older vehicle owners.

- Complex Policy Management: Dynamic premiums and frequent adjustments challenge customer comprehension and require clear communication.

- Technology Dependence: Mechanical issues outside sensor coverage may still escape predictive systems.

What Car Owners Should Know

- Explore PAYD Options: If driving fewer kilometers annually, inquire about PAYD insurance policies that could reduce your premiums.

- Embrace Connected Vehicle Capabilities: New vehicles increasingly include telematics hardware enabling predictive maintenance—owners benefit from monitoring apps and alerts.

- Maintain Transparent Records: Keep service and mileage data up to date to optimize insurance and vehicle health benefits.

- Be Proactive: Respond to maintenance alerts swiftly to maximize savings and vehicle reliability.

The Road Ahead: Future Trends

In the upcoming years, expect PAYD policies to integrate deeper AI-driven driving behavior analysis, real-time risk assessment, and dynamic pricing. Predictive maintenance will expand beyond traditional mechanical parts into software updates, electric vehicle battery health monitoring, and autonomous system diagnostics.

Further integration will enable automated insurance adjustments corresponding to vehicle condition and usage dynamically during the policy period, closing the feedback loop between owner behavior, vehicle health, and insurance cost.

Conclusion

The future of car insurance and maintenance in 2025 is undeniably shaped by the dual forces of Pay-As-You-Drive insurance and predictive repair technologies. PAYD offers a fairer, usage-based pricing model rewarding responsible, low-mileage drivers, while predictive maintenance ensures vehicles receive timely care before failures occur.

Together, these innovations promise to lower overall ownership costs, improve vehicle safety and reliability, promote ecological benefits, and herald a new era of smart, connected automotive care. Car owners, insurers, and service providers embracing these advancements today will enjoy a competitive advantage and a smoother, more affordable vehicle ownership experience in the years ahead.